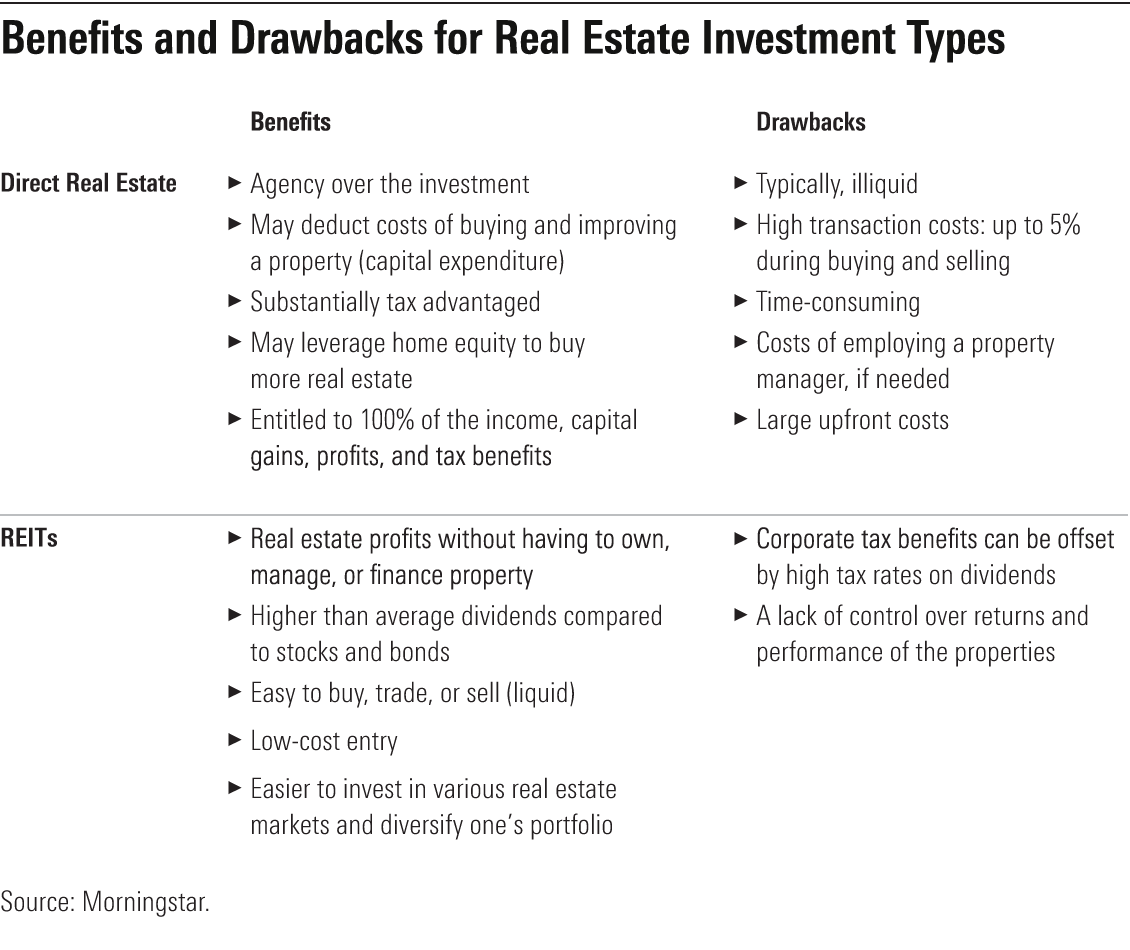

It is important to learn about the company before buying a REIT. Research the company's history, and how it compares to its competitors. This way, you will be able to determine whether or not it will pay dividends well. Be aware of the risks involved in buying REITs.

Tip to Buy REITs

You should consider the quality of REITs and the earnings before investing. The company's earnings are made up of any dividends and funds from its properties. It is also important to consider the fees associated for the investment. Diversification of REITs is also important. Some REITs have a high level of investment in certain types of properties, which can increase the chance of a loss. You can reduce your risk by investing in multiple REITs and diversifying your portfolio.

It is possible to set up a brokerage to invest in REITs. This allows you to purchase and sell publicly traded REITs in a matter of minutes. Many of these investments pay high dividends. Some REITs also have the option of keeping your funds in a tax-favored account, which means you won't pay taxes on the money you receive as distributions.

Dividends are subject to tax

Investors need to be aware of taxes on dividends when buying REITs. Capital gains are when a REIT sells real estate assets. These capital gains can be included in dividends. The amount of tax due will depend on whether the investor qualifies for special tax concessions or not. If the investor is not eligible for special tax concessions the dividend will be subject to the marginal tax rate.

An investor can avoid taxes by purchasing REITs that don't require close ownership. Avoid REITs without a five year dividend history. A REIT cannot be held by more that 50% of individuals. The Tax Cuts and Jobs Act (new tax law) allows pass-through income to be deducted 20%.

Liquidity

For REITs, liquidity is an important consideration. It can help them resist unexpected changes to the asset's value. REITs have the ability to increase their value by giving a portion of their earnings back to investors. REITs took advantage lower interest rates in recent times to increase their cash balances, and improve their liquidity. However, REITs should not be treated as a safe investment - volatility is an inherent part of the business.

Additionally, REITs provide liquidity for investors as shares can be bought and sold on the stock exchange. Investors have access to liquidity that can be used to access cash and change their investment strategies. Investors may also find REITs appealing because real estate is an uncorrelated asset class.

There are risks involved in investing in REITs

REITs may provide steady income in dividends but investors should remember that REITs cannot be considered risk-free investments. The reason is that REITs trade just like stocks and may lose value. REIT stocks can be risky investments. However, they have to compete with other high yield investment options.

Interest rate risk is another important risk. Rising interest rates could lead to increased borrowing costs for REITs. This will impact their cash flows. These risks can be mitigated due to the solid balance sheets of REITs. These managers try to maintain a healthy amount of leverage. Investors should be aware of this fact.

When to Buy

Before you decide to invest your money in REITs, consider your financial situation. You should also understand the tax implications of REITs. REITs are not the best investment option for those who want to maximize their tax advantage because they generate most of their income through dividend income.

Uncertainty around the expiration date for master leases is a big problem for REITs. Investors are often driven to sell due to this uncertainty. Investors' fundamentals have suffered as a result. Despite the uncertainty many investors fail to realize the fact short-term issues don't have much impact on the long-term prospects.

FAQ

What should I do if I want to use a mortgage broker

Consider a mortgage broker if you want to get a better rate. Brokers work with multiple lenders and negotiate deals on your behalf. However, some brokers take a commission from the lenders. Before you sign up, be sure to review all fees associated.

What should you consider when investing in real estate?

The first step is to make sure you have enough money to buy real estate. You can borrow money from a bank or financial institution if you don't have enough money. You also need to ensure you are not going into debt because you cannot afford to pay back what you owe if you default on the loan.

You must also be clear about how much you have to spend on your investment property each monthly. This amount must cover all expenses related to owning the property, including mortgage payments, taxes, insurance, and maintenance costs.

Also, make sure that you have a safe area to invest in property. It would be best to look at properties while you are away.

Do I need to rent or buy a condo?

Renting could be a good choice if you intend to rent your condo for a shorter period. Renting will allow you to avoid the monthly maintenance fees and other charges. A condo purchase gives you full ownership of the unit. You are free to make use of the space as you wish.

What time does it take to get my home sold?

It all depends on several factors such as the condition of your house, the number and availability of comparable homes for sale in your area, the demand for your type of home, local housing market conditions, and so forth. It can take from 7 days up to 90 days depending on these variables.

How long does it usually take to get your mortgage approved?

It all depends on your credit score, income level, and type of loan. It usually takes between 30 and 60 days to get approved for a mortgage.

What are the pros and cons of a fixed-rate loan?

A fixed-rate mortgage locks in your interest rate for the term of the loan. You won't need to worry about rising interest rates. Fixed-rate loans offer lower payments due to the fact that they're locked for a fixed term.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

How to Manage A Rental Property

It can be a great way for you to make extra income, but there are many things to consider before you rent your house. We'll help you understand what to look for when renting out your home.

If you're considering renting out your home, here's everything you need to know to start.

-

What are the first things I should consider? You need to assess your finances before renting out your home. You may not be financially able to rent out your house to someone else if you have credit card debts or mortgage payments. Also, you should review your budget to see if there is enough money to pay your monthly expenses (rent and utilities, insurance, etc. You might find it not worth it.

-

How much will it cost to rent my house? There are many factors that influence the price you might charge for renting out your home. These include factors such as location, size, condition, and season. Keep in mind that prices will vary depending upon where you live. So don't expect to find the same price everywhere. The average market price for renting a one-bedroom flat in London is PS1,400 per month, according to Rightmove. This means that your home would be worth around PS2,800 per annum if it was rented out completely. While this isn't bad, if only you wanted to rent out a small portion of your house, you could make much more.

-

Is this worth it? There are always risks when you do something new. However, it can bring in additional income. It is important to understand your rights and responsibilities before signing anything. You will need to pay maintenance costs, make repairs, and maintain the home. Renting your house is not just about spending more time with your family. You should make sure that you have thoroughly considered all aspects before you sign on!

-

Is there any benefit? You now know the costs of renting out your house and feel confident in its value. Now, think about the benefits. Renting your home is a great way to get out of the grind and enjoy some peace from your day. It is more relaxing than working every hour of the day. If you plan well, renting could become a full-time occupation.

-

How do I find tenants After you have decided to rent your property, you will need to properly advertise it. Start by listing online using websites like Zoopla and Rightmove. Once potential tenants reach out to you, schedule an interview. This will enable you to evaluate their suitability and verify that they are financially stable enough for you to rent your home.

-

How can I make sure I'm covered? You should make sure your home is fully insured against theft, fire, and damage. In order to protect your home, you will need to either insure it through your landlord or directly with an insured. Your landlord will often require you to add them to your policy as an additional insured. This means that they'll pay for damages to your property while you're not there. If you are not registered with UK insurers or if your landlord lives abroad, however, this does not apply. In such cases you will need a registration with an international insurance.

-

It's easy to feel that you don't have the time or money to look for tenants. This is especially true if you work from home. However, it is important that you advertise your property in the best way possible. Post ads online and create a professional-looking site. You'll also need to prepare a thorough application form and provide references. While some prefer to do all the work themselves, others hire professionals who can handle most of it. In either case, be prepared to answer any questions that may arise during interviews.

-

What do I do when I find my tenant. If you have a lease in place, you'll need to inform your tenant of changes, such as moving dates. You may also negotiate terms such as length of stay and deposit. You should remember that although you may be paid after the tenancy ends, you still need money for utilities.

-

How do I collect my rent? When the time comes to collect the rent, you'll need to check whether your tenant has paid up. You will need to remind your tenant of their obligations if they don't pay. Any outstanding rents can be deducted from future rents, before you send them a final bill. If you are having difficulty finding your tenant, you can always contact the police. They will not normally expel someone unless there has been a breach of contract. However, they can issue warrants if necessary.

-

How can I avoid problems? Renting out your house can make you a lot of money, but it's also important to stay safe. Ensure you install smoke alarms and carbon monoxide detectors and consider installing security cameras. Check with your neighbors to make sure that you are allowed to leave your property open at night. Also ensure that you have sufficient insurance. Finally, you should never let strangers into your house, even if they say they're moving in next door.