If you are selling your home without a realtor, you may want to consider getting a buyer's agent. This agent coordinates signing various documents and makes sure that all conditions are met. They then record the deed, and transfer title.

A house can be sold by the owner without the involvement of a realtor

Selling your home by yourself without the assistance of a realtor can save you money. A full commission could cost you between five percent and seven per cent of the sale price. You can reduce or eliminate the commission and sell your home faster. This isn't an easy process. You will need to devote a great deal of your time to the sale. Moreover, you will have to spend time showing your house and meeting with potential buyers. This can prove to be very challenging if you have work during the showings.

Realtors may charge a significant commission. Your agent would get $10,500 if you sold your house for $350,000. This money is enough to cover the cost of an agent's work. Selling your home yourself will also give you extra money in your bank accounts.

Agent for buyers

The buyer's agent should be paid a commission, but they shouldn't be the only person involved in the transaction. A seller agent should represent your interests. An agent will help you to navigate through paperwork and make sure everything runs smoothly. An agent can help you get the best deal possible for your house.

You will also benefit from the knowledge and experience gained by a buyer agent when selling homes. They can walk you through a property and point out problems that can be fixed to attract buyers. An agent can also highlight important inspection issues and ensure that all legal boxes are checked.

Pricing your home

You may wonder how to price your home if you are selling your home without the help of a realtor. The best way to ensure your home sells is by hiring a real estate agent. They will help you create a list price that will reflect the value of your home. It is important to price your home correctly. However, there are some things you should consider.

To set the price of your home, you need to do a market study. To determine the value of your property, you'll need a market analysis that compares recent sales in your neighborhood. Don't let emotion influence your pricing decision. Even if your house is a dream, that doesn't mean it will sell. Review recent sales of similar homes in the area, and look for similar features. You can also access a Federal Housing Finance Agency-provided standardized HPI calculation, but do not take it as gospel.

Accepting offers

A buyer who accepts an agent's offer to buy a house is permitted to accept it without paying a commission. However, it is important to remember that the seller is still responsible for the agent's fees. In some states, the buyer's agent may also be the seller's agent. Dual agency is also known and the agent won't be able to fully represent both buyers and sellers.

If you decide to accept an offer, make sure to read the terms and conditions. The terms of an offer might include conditions that the seller wants to avoid. If the buyer isn't a U.S. citizen, discriminating based on race is prohibited. You also can't refuse to sell your home to someone because of their religion.

FAQ

What are the 3 most important considerations when buying a property?

The three most important things when buying any kind of home are size, price, or location. Location refers the area you desire to live. Price refers the amount that you are willing and able to pay for the property. Size refers the area you need.

How can I tell if my house has value?

If your asking price is too low, it may be because you aren't pricing your home correctly. You may not get enough interest in the home if your asking price is lower than the market value. For more information on current market conditions, download our Home Value Report.

How do I calculate my rate of interest?

Market conditions impact the rates of interest. In the last week, the average interest rate was 4.39%. Multiply the length of the loan by the interest rate to calculate the interest rate. For example, if $200,000 is borrowed over 20 years at 5%/year, the interest rate will be 0.05x20 1%. That's ten basis points.

What is the average time it takes to sell my house?

It depends on many factors including the condition and number of homes similar to yours that are currently for sale, the overall demand in your local area for homes, the housing market conditions, the local housing market, and others. It can take from 7 days up to 90 days depending on these variables.

What should I do before I purchase a house in my area?

It depends on how long you plan to live there. Save now if the goal is to stay for at most five years. But, if your goal is to move within the next two-years, you don’t have to be too concerned.

Is it possible for a house to be sold quickly?

If you plan to move out of your current residence within the next few months, it may be possible to sell your house quickly. But there are some important things you need to know before selling your house. First, you will need to find a buyer. Second, you will need to negotiate a deal. Second, prepare your property for sale. Third, it is important to market your property. Finally, you need to accept offers made to you.

How much money can I get to buy my house?

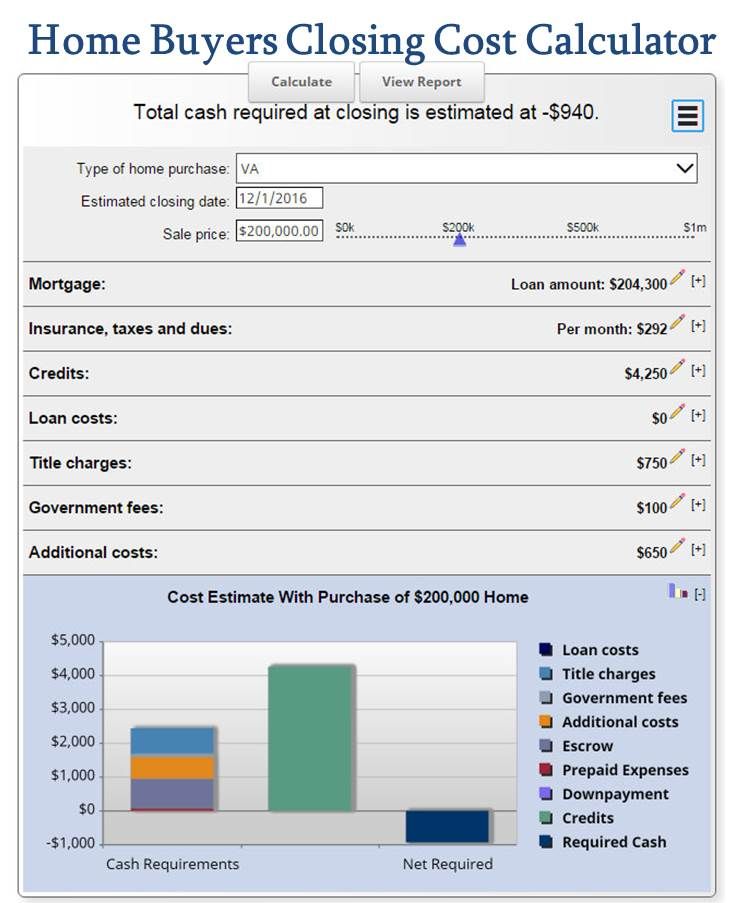

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. Zillow.com says that the average selling cost for a US house is $203,000 This

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to Find Real Estate Agents

Agents play an important role in the real-estate market. They are responsible for selling homes and property, providing property management services and legal advice. The best real estate agent will have experience in the field, knowledge of your area, and good communication skills. Look online reviews to find qualified professionals and ask family members for recommendations. Local realtors may also be an option.

Realtors work with buyers and sellers of residential properties. A realtor's job it to help clients purchase or sell their homes. Apart from helping clients find the perfect house to call their own, realtors help manage inspections, negotiate contracts and coordinate closing costs. A commission fee is usually charged by realtors based on the selling price of the property. Unless the transaction closes however, there are some realtors who don't charge a commission fee.

The National Association of REALTORS(r) (NAR) offers several different types of realtors. NAR membership is open to licensed realtors who pass a written test and pay fees. To become certified, realtors must complete a course and pass an examination. NAR has established standards for accredited realtors.