It is possible to save money by buying a home with cash. It is not always the most cost-effective option.

Despite the increasing popularity of buying a home with cash, it's important to know the pros and cons before making the decision. It's also vital to find out if you qualify for buying a home with cash.

Can I Buy a House With Cash?

Buying a home with cash can be a great way to make sure you get the right house at the right price. It is advantageous to pay for your home in cash. This way, you will not have to make mortgage payments each month, eliminate interest payments, or spend money on closing fees.

The buyer should be in a position to show sufficient funds within a week of signing a deal, if necessary. This evidence may be in the shape of a bank account statement or a letter issued by a financial institution.

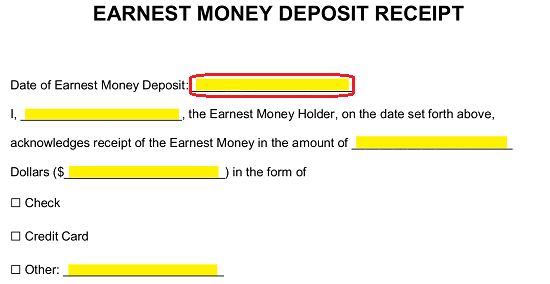

When a buyer submits a cash offer, they must be prepared to provide a deposit to secure the home, referred to as earnest money or good faith deposit. The deposit amount should be small, usually around 1%.

The earnest money deposit amount will vary depending on the purchase. However, it should be sufficient to show that you are serious about buying the house and can afford to do so. The deposit will let the seller see that you are serious and act as a sign of good faith.

What can I buy a house with cash?

Paying for a house with cash can be a good idea if you have a large amount of liquid funds in savings, checking and money market accounts. Cash can be useful to buyers who may have difficulty obtaining a mortgage or who wish to save in a market with high risks.

Having a large amount of cash can also be helpful if you have a thin credit file, which can prevent you from getting a mortgage. This can happen to immigrants, people who have moved back to the United States after living abroad for a while or those who avoid using credit altogether.

A cash payment for your home can enable you to buy homes that you would not be able otherwise to afford. Most people can't afford to buy a home with a loan because homes are usually more expensive than average income.

In this competitive housing market, it is difficult to predict when a house will sell. If a sale is contingent on financing or an appraisal, there's always a chance that the loan could fall through or the property doesn't appraise.

A lot of sellers are happy to have a cash offer because it takes the risk of a loan off their hands and gives them more deal certainty. A seller will also appreciate the fact they are able to complete a sale quicker and that there is less movement involved.

FAQ

Do I need flood insurance?

Flood Insurance covers flooding-related damages. Flood insurance helps protect your belongings, and your mortgage payments. Learn more about flood coverage here.

How much does it cost to replace windows?

Window replacement costs range from $1,500 to $3,000 per window. The total cost of replacing all of your windows will depend on the exact size, style, and brand of windows you choose.

How do I get rid termites & other pests from my home?

Over time, termites and other pests can take over your home. They can cause serious destruction to wooden structures like decks and furniture. A professional pest control company should be hired to inspect your house regularly to prevent this.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

External Links

How To

How to become a broker of real estate

You must first take an introductory course to become a licensed real estate agent.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This requires that you study for at most 2 hours per days over 3 months.

You are now ready to take your final exam. To be a licensed real estate agent, you must achieve a minimum score of 80%.

If you pass all these exams, then you are now qualified to start working as a real estate agent!