Renters often use leasing with an option to purchase to gain access to the housing market. They can also save on a down payment because they don't have to move and build equity over time.

Lease homes with the option of buying them

In a Lease-Option to Purchase Home, a landlord will agree with the tenant to pay an option fee to begin the lease. The renter then has the right to buy the house at any time during the rental period. The renter is required to pay a fee for the option and money every month towards a deposit.

Typically, lease options are for one to three year terms. However, they can be extended if the landlord and tenant agree. The contract needs to clearly state what the final prospective purchase price will be. It should not change even when market rates fluctuate.

It is best to speak to a lender and research the local housing market before deciding if a Lease-Option to Buy is for you. It's important to find out if you can qualify for a mortgage and complete the purchase within the option period.

Be sure to maintain meticulous records of your rent payments throughout the lease period so that you can show a history of timely rental payments when it's time to apply for a loan. You will be able to get the lowest rate on a mortgage if you keep meticulous records of your rent payments.

You should keep an eye on any changes to your score over the course of the lease. This will help you secure a better interest rate for a mortgage once it is time to buy the car.

Also, it's a good idea for you to look at the value of leased-optioned properties during the period of option so that you know what the purchase price will be when the term ends. If the home value falls below the purchase cost, this could lead to problems with your loan application.

The lease-option agreement isn't without its drawbacks, but it can be a great way to start the process of homeownership while saving a significant down payment and building equity in a home.

Some lease options include clauses that require the tenant to reimburse the vendor if they sell the home at a lesser price than what was originally paid. It's frustrating for tenants to be forced to pay back the money that they saved by leasing the house with an option.

Make sure you have a properly-drafted contract and that the lender will allow you the use of your option fee for the purchase. It's important to compare banks and find one that accepts it.

Whether you are considering a lease-option to buy or a lease-purchase, it's important to work with an experienced real estate attorney who can help you get the deal you deserve. We can negotiate the terms that are best for you, including making sure your options and choices are understood.

FAQ

What are the three most important factors when buying a house?

The three most important things when buying any kind of home are size, price, or location. Location refers to where you want to live. Price refers to what you're willing to pay for the property. Size refers to the space that you need.

How can you tell if your house is worth selling?

You may have an asking price too low because your home was not priced correctly. Your asking price should be well below the market value to ensure that there is enough interest in your property. You can use our free Home Value Report to learn more about the current market conditions.

What should you consider when investing in real estate?

First, ensure that you have enough cash to invest in real property. If you don't have any money saved up for this purpose, you need to borrow from a bank or other financial institution. You also need to ensure you are not going into debt because you cannot afford to pay back what you owe if you default on the loan.

You must also be clear about how much you have to spend on your investment property each monthly. This amount should include mortgage payments, taxes, insurance and maintenance costs.

Finally, ensure the safety of your area before you buy an investment property. It would be best if you lived elsewhere while looking at properties.

Do I require flood insurance?

Flood Insurance protects you from flooding damage. Flood insurance protects your belongings and helps you to pay your mortgage. Find out more information on flood insurance.

How much money can I get to buy my house?

This can vary greatly depending on many factors like the condition of your house and how long it's been on the market. The average selling price for a home in the US is $203,000, according to Zillow.com. This

Is it better to buy or rent?

Renting is generally cheaper than buying a home. But, it's important to understand that you'll have to pay for additional expenses like utilities, repairs, and maintenance. The benefits of buying a house are not only obvious but also numerous. For instance, you will have more control over your living situation.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

How to Locate Real Estate Agents

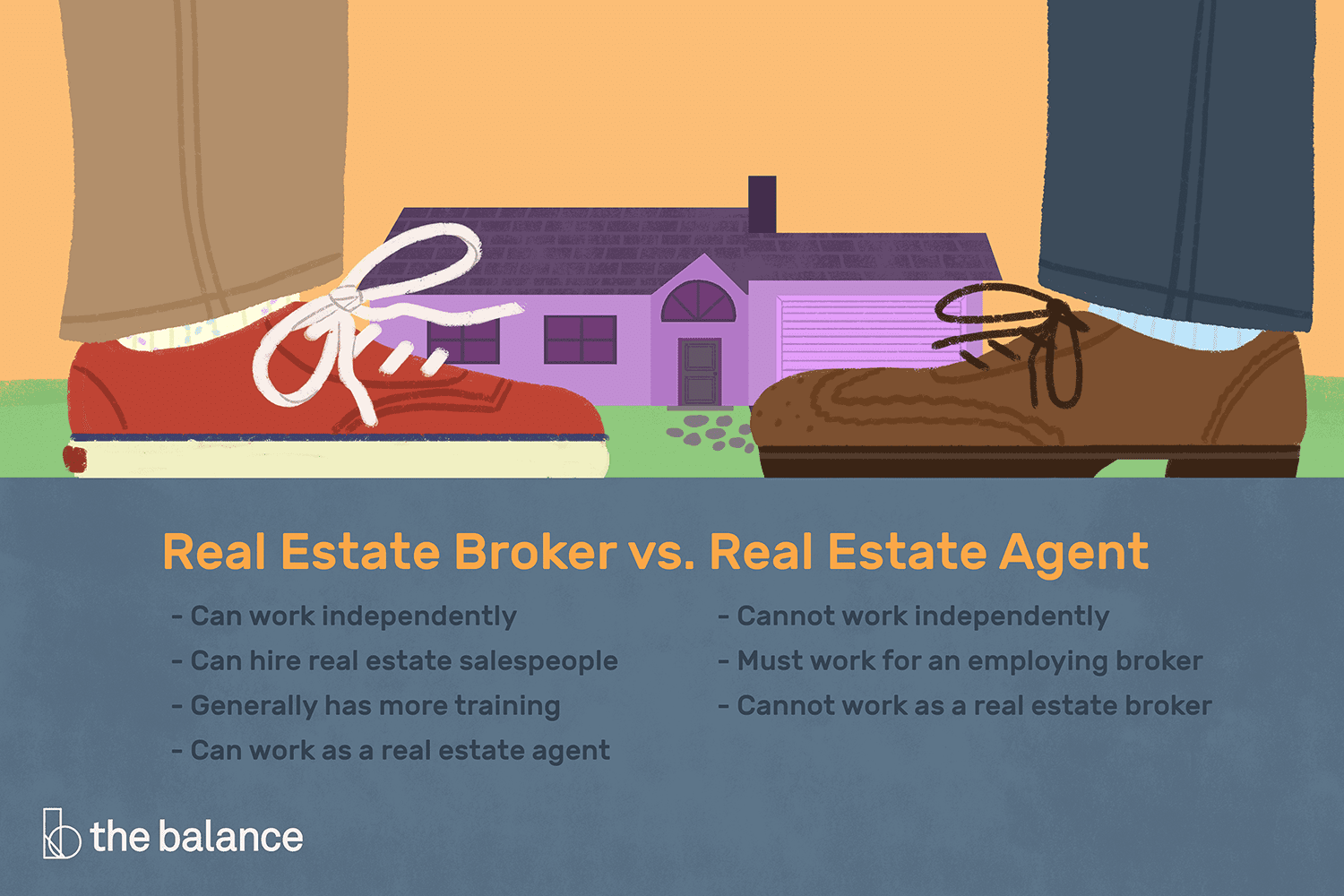

The real estate market is dominated by agents. They are responsible for selling homes and property, providing property management services and legal advice. A good real estate agent should have extensive knowledge in their field and excellent communication skills. Look online reviews to find qualified professionals and ask family members for recommendations. Local realtors may also be an option.

Realtors work with buyers and sellers of residential properties. The job of a realtor is to assist clients in buying or selling their homes. A realtor helps clients find the right house. They also help with negotiations, inspections, and coordination of closing costs. Most realtors charge a commission fee based on the sale price of the property. However, some realtors don't charge a fee unless the transaction closes.

The National Association of Realtors(r), (NAR), has several types of licensed realtors. NAR membership is open to licensed realtors who pass a written test and pay fees. The course must be passed and the exam must be passed by certified realtors. NAR has established standards for accredited realtors.