What's the difference between a Real estate agent and a real estate broker? Both have different functions so here are some differences. You might want to hire an agent, or a broker, if you are trying to buy or sell your home. Both are valuable, so the choice is yours. Read our comparison article on broker vs agent to learn more.

Real estate agent

Although there are differences in the roles of brokers and agents, they both play a vital role in ensuring a smooth home buying experience. While brokers manage the legalities of buying a home, buyers' agents help to find properties and negotiate offers. Brokers assist with the paperwork and keep escrow funds. The role of a buyer's agents is to help buyers navigate the buying process and find the perfect house. In some jurisdictions, agents are sometimes called brokers.

Real estate agents are licensed salespeople. Realtors are licensed to sell real estate. Both are required to hold real estate licenses by law. They must also adhere to strict codes of ethics. Real estate agents must be members of the National Association of Realtors, and adhere to the code of ethics. A broker is a licensed real-estate agent. The two roles are therefore very different.

Agent for the buyer

Your individual situation should guide your decision about whether to use a buyer's broker or agent. The first is legally required to represent the best interests of the buyer. The buyer's representative, however, is required to represent the buyer's best interests. Because buyer's agents have the benefit of an outsider's perspective, they are often better suited to assist buyers. Buyers need to be aware of the drawbacks and benefits of working with a buyer agent.

A buyer's agent can provide a variety of services, including market analysis, evaluating comparable sales, and determining the offer value based on the features of the property. They may also be able to assist with other terms and conditions, such as preparing a coop board package. A buyer's agency can also help with dealing with the unexpected speed bumps in a transaction. The agent can help you avoid those speed bumps by making sure that you don't make a mistake that could cost you thousands.

Insurance broker

If you're looking to buy insurance, deciding between an insurance broker and an agent can be an important decision. An insurance agent must be licensed by the state. Agents are often tied to one or two insurance companies. Brokers, on other hand, allow you to compare multiple options, which can save you significant time. Here are a few of the reasons you should choose to work with an insurance broker.

Their representation is the most important difference between an agent and an broker. While an insurance agent represents an insurer, a broker represents an insurance buyer. Independent or captive, a broker can represent any number insurance companies. A broker can represent many different insurance companies and will typically have a wider network. Brokers can represent many insurers, but insurance agents may only represent one. This difference is substantial.

FAQ

How many times can my mortgage be refinanced?

It depends on whether you're refinancing with another lender, or using a broker to help you find a mortgage. In both cases, you can usually refinance every five years.

What is the average time it takes to sell my house?

It all depends upon many factors. These include the condition of the home, whether there are any similar homes on the market, the general demand for homes in the area, and the conditions of the local housing markets. It may take up to 7 days, 90 days or more depending upon these factors.

Can I buy a house without having a down payment?

Yes! There are programs available that allow people who don't have large amounts of cash to purchase a home. These programs include FHA loans, VA loans. USDA loans and conventional mortgages. Visit our website for more information.

What can I do to fix my roof?

Roofs may leak from improper maintenance, age, and weather. Roofing contractors can help with minor repairs and replacements. Get in touch with us to learn more.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to become a broker of real estate

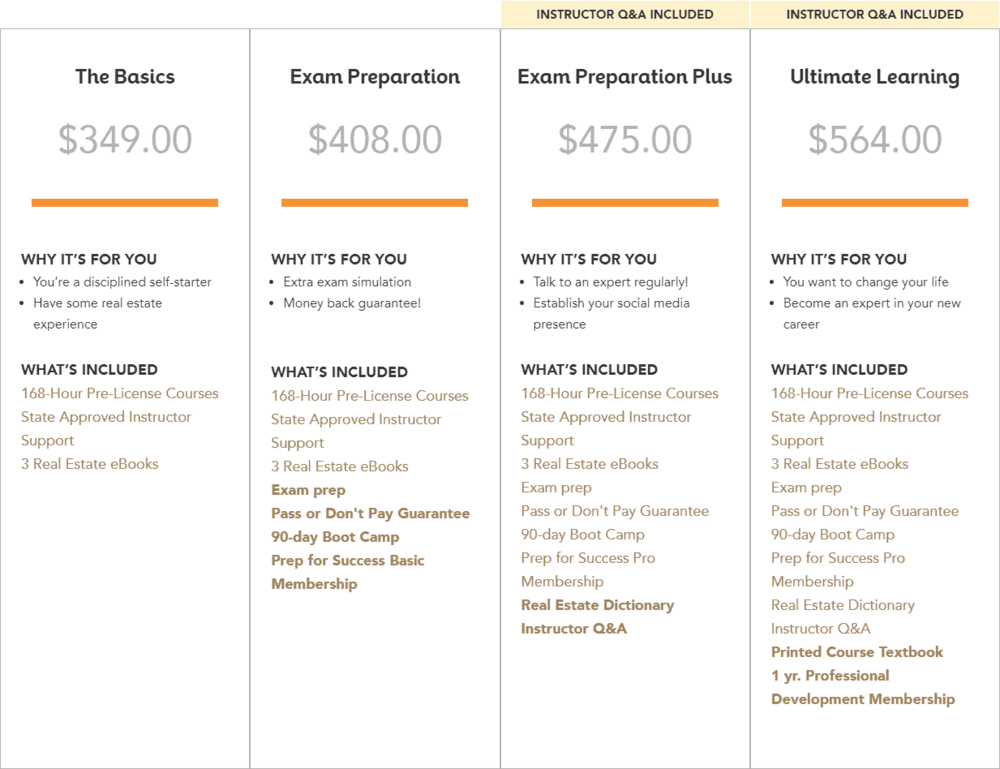

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

Next, pass a qualifying test that will assess your knowledge of the subject. This means that you will need to study at least 2 hours per week for 3 months.

You are now ready to take your final exam. In order to become a real estate agent, your score must be at least 80%.

These exams are passed and you can now work as an agent in real estate.