Having a real estate career is a dream for many people. But it can be hard to get started. Luckily, you can break into the industry on a part time basis. Actually, you could make more money than what you think.

An average agent for real estate makes 2.5 to 3 percent of the sale price of the property he or she assists. This number may vary depending on where you are located. States with higher living costs have the highest average annual salaries. California's median home worth is $440,000. The average agent earns $65,087 to $102,787 annually.

First, decide whether you would like to work full-time or part-time if you are interested pursuing a career in real estate. This decision will have a direct impact on your salary. A broker should be able to help you find part-time work.

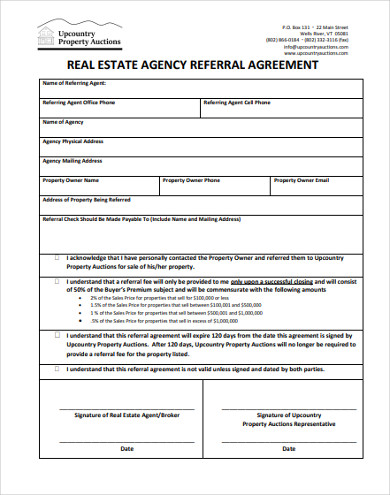

You'll also need to be able to manage your time effectively. Part-time real estate agents often start their career as part-time workers and move up to full-time. A full-time job will give you more flexibility in your work schedule. This will allow you to expand your sphere of influence and earn referral fees. This will reduce your risk of financial loss as you can still work full-time and still make a decent living.

There's no "get rich quick" scheme in the real estate business. To succeed in the real estate business, you need to be patient and work hard to establish a client base. It is important to provide excellent customer services. A strong client base can be a source of referrals for years to come.

If you're interested in a part time career in realty, you will need to find an agency that can help you. This is especially important if you are just starting out. A good brokerage will be able to explain the process in detail and give you the opportunity to show off your talents.

When you're deciding on a brokerage, you should also consider the broker's commission split. While you will likely need to pay a start up fee, a brokerage that has a favorable 70/30 split is likely to give you more take-home income. This contrasts with a brokerage with a low cap. You'll get less at the beginning.

It is important to remember that you can't work part-time in the real estate business. You will need to be committed to your clients. This can make the difference of an accepted or rejected offer. If clients don't receive a response quickly, they might get very testy.

You'll also need to spend a lot of time selling. You can achieve this best by being part of a team. You will need to refer prospective clients to fellow agents if you're part-time as a real estate agent.

FAQ

What are the advantages of a fixed rate mortgage?

Fixed-rate mortgages lock you in to the same interest rate for the entire term of your loan. This will ensure that there are no rising interest rates. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

What is a reverse mortgage?

A reverse mortgage lets you borrow money directly from your home. It allows you access to your home equity and allow you to live there while drawing down money. There are two types of reverse mortgages: the government-insured FHA and the conventional. You must repay the amount borrowed and pay an origination fee for a conventional reverse loan. If you choose FHA insurance, the repayment is covered by the federal government.

How can I eliminate termites & other insects?

Termites and other pests will eat away at your home over time. They can cause damage to wooden structures such as furniture and decks. This can be prevented by having a professional pest controller inspect your home.

How can I tell if my house has value?

You may have an asking price too low because your home was not priced correctly. If your asking price is significantly below the market value, there might not be enough interest. Our free Home Value Report will provide you with information about current market conditions.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to Locate Houses for Rent

Finding houses to rent is one of the most common tasks for people who want to move into new places. It can be difficult to find the right home. Many factors affect your decision-making process when choosing a home. These factors include price, location, size, number, amenities, and so forth.

You should start looking at properties early to make sure that you get the best price. You should also consider asking friends, family members, landlords, real estate agents, and property managers for recommendations. This will allow you to have many choices.